Table of Content

Lower interest rate – Interest rates on 15-year loans are usually lower than on 30-year loans. The main advantages of a 15-year fixed mortgage are outlined below. Each Advertiser is responsible for the accuracy and availability of its own advertised terms. Bankrate cannot guaranty the accuracy or availability of any loan term shown above.

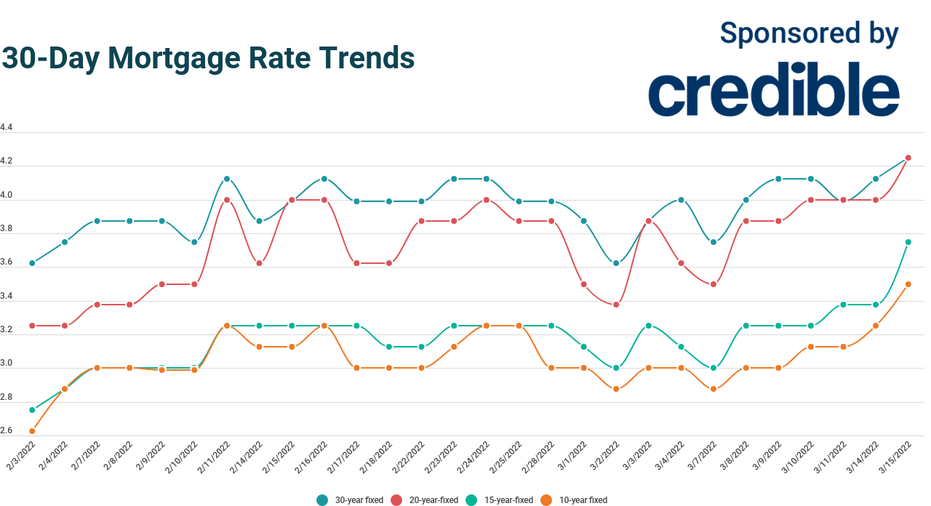

No matter what kind of refinance you choose, once you close on your new loan, the payment clock goes back to zero. For example, if you take out a new 30-year mortgage, you’ll have another 30 years of payments ahead of you. "Until inflation peaks, mortgage rates won't either," says Greg McBride, CFA, Bankrate chief financial analyst. The average 30-year fixed-refinance rate is 6.54 percent, down 13 basis points over the last seven days.

What does it cost to refinance?

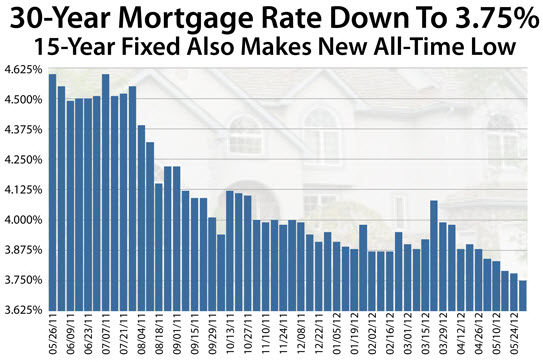

Instead of lowering their monthly payment, as a 30-year refinance would do, the new 15-year term increases this borrower’s payment by $460 per month. With a 15-year refinance, this homeowner would pay only $45,500 in interest over their new loan term. That’s less than half the cost of interest on a new 30-year loan — a total savings of more than $73,000. 15-year mortgage rates are usually lower than 30-year fixed rates, but the spread can change daily.

If you don’t mind a higher monthly payment, you might find a 15-year mortgage to be a more attractive option than a longer-term loan. If you’re looking to refinance, it’s smart to consider a 15-year loan, especially if you’re more than halfway through repaying your current 30-year loan. Refinancing into another 30-year loan would extend your repayment period, which costs more in the long run. Some people choose an ARM when they purchase their home, perhaps because they didn’t plan to stay in the home for long or needed a low monthly payment to get settled.

Should I Refinance Right Now?

These limits are strictly followed by Fannie Mae and Freddie Mac to determine if loans qualify for financing. 2022 conforming loan limits for different types of housing are posted on the FHFA website. Meanwhile, the Urban Institute reported that 30-year FRMs made up 74.2% of new loan originations in 2020, while 0.9% accounted for ARMs. The remaining 8% represented other types of mortgage products, such as 10-year and 20-year fixed-rate loans.

If you refinance to a new 30-year loan now, you’ll still be making mortgage payments when you’re 75 — and you’ll be paying interest a lot longer. Just remember that if you shorten your term, your monthly payments will increase—so be sure to check if a higher payment will comfortably fit into your budget. With a mortgage, you have the option to buy discount points, which are essentially fees you’ll pay at closing in return for a lower interest rate. Buying points might be worth it if you plan to stay in your home for an extended period of time. If you have a 20-year or 30-year loan and refinance it into a 15-year loan, your monthly payments will increase.

FIRE Calculator: Find Your FIRE Number Now

If you are seeking a loan for more than $548,250, lenders in certain locations may be able to provide terms that are different from those shown in the table above. You should confirm your terms with the lender for your requested loan amount. At Bankrate we strive to help you make smarter financial decisions. While we adhere to strict editorial integrity, this post may contain references to products from our partners. Before joining Bankrate in 2020, he wrote about real estate and the economy for the Palm Beach Post and the South Florida Business Journal. Home loans that conform to loan limits required by the Federal Housing Finance Agency are called conforming conventional loans.

A month ago, the average rate on a 30-year fixed refinance was higher, at 6.88 percent. The offers that appear on this site are from companies that compensate us. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories. But this compensation does not influence the information we publish, or the reviews that you see on this site.

Conforming Conventional Mortgages

We work hard to ensure our recommendations and advice are unbiased, empirical, and based on thorough research. Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout life’s financial journey. Bankrate follows a strict editorial policy, so you can trust that we’re putting your interests first. While we adhere to stricteditorial integrity, this post may contain references to products from our partners.

If the borrower-equity is less than 20%, mortgage insurance may be required, which could increase the monthly payment and the APR. Estimated monthly payment does not include amounts for taxes and insurance premiums and the actual payment obligation will be greater. But in this case, the time could be right for refinancing to a 15-year loan. For another, you’ll have a lower principal balance after all those years of repayment. The above mortgage loan information is provided to, or obtained by, Bankrate.

When you shop, consider not just the interest rate you’re being quoted, but also all the other terms of the loan. Be sure to compare APRs, which include many additional costs of the mortgage not shown in the interest rate. Some institutions may have lower closing costs and fees than others, or your current bank or credit union may extend you a special offer. At the current interest rate of 5.93%, a borrower using a 15-year, fixed-rate mortgage refinance of $300,000 would pay $2,520 per month in principal and interest. That borrower would pay roughly $153,643 in total interest over the 15-year life of the loan.

You agree that your decision to make available any sensitive or confidential information is your sole responsibility and at your sole risk. Interest.com has no control and makes no representations as to the use or disclosure of information provided to third parties. You agree that these third party services are not under Interest.com’s control, and that Interest.com is not responsible for any third party’s use of your information.

Both the 15-year fixed and 30-year fixed saw their average rates recede. The average rate on 10-year fixed refinance mortgages also decreased. A 15-year refinance could net you a much lower rate and save you thousands in mortgage interest. As an alternative, you can usually pay down your 30-year mortgage very effectively by putting in a big lump sum or increasing your regular mortgage payments.

To receive the Bankrate.com rate, you must identify yourself to the Advertiser as a Bankrate.com customer. This will typically be done by phone so you should look for the Advertisers phone number when you click-through to their website. The following chart summarizes the pros and cons of choosing a 15-year fixed-rate mortgage. In 2022, the conforming loan limit for single-family homes is $647,200 in US continental areas. If your mortgage falls within this amount, your loan qualifies as a conforming conventional mortgage.

Top offers on Bankrate vs. the national average interest rate

At NextAdvisor we’re firm believers in transparency and editorial independence. Editorial opinions are ours alone and have not been previously reviewed, approved, or endorsed by our partners. Editorial content from NextAdvisor is separate from TIME editorial content and is created by a different team of writers and editors.

No comments:

Post a Comment