Table of Content

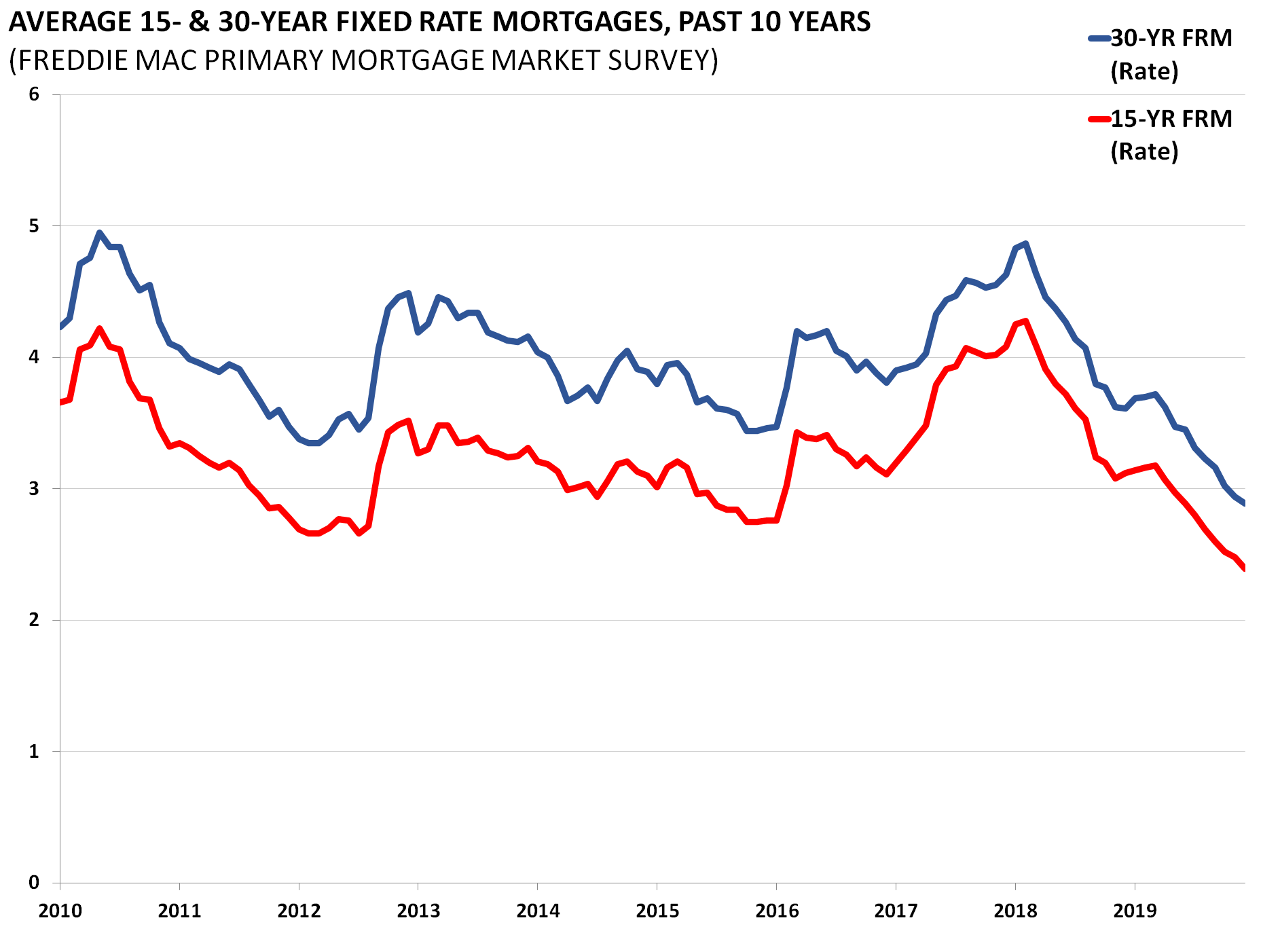

Whether you're buying or refinancing, Bankrate often has offers well below the national average to help you finance your home for less. Compare rates here, then click "Next" to get started in finding your personalized quotes. For today, Wednesday, December 21, 2022, the national average 15-year fixed refinance APR is 6.04%, up compared to last week's of 5.96%. The national average 15-year fixed mortgage APR is 5.90%, down compared to last week's of 6.03%.

Alix is a staff writer for CNET Money where she focuses on real estate, housing and the mortgage industry. She previously reported on retirement and investing for Money.com and was a staff writer at Time magazine. She graduated from the Craig Newmark Graduate School of Journalism at CUNY and Villanova University. When not checking Twitter, Alix likes to hike, play tennis and watch her neighbors' dogs. Now based out of Los Angeles, Alix doesn't miss the New York City subway one bit.

Refinance Rates for December 15, 2022

Conventional lenders require PMI when borrowers pay below 20% down payment on their mortgage. This is an extra charge that protects lenders in case borrowers fail to pay back their loan. PMI is typically included in monthly mortgage payments, which may cost anywhere between 0.25% to 2% of your loan per year. This fee is only required for a limited period and is removed once your loan’s loan-to-value ratio reaches 78%. Comparing offers is critical to get the best deal on your mortgage.

If you find any errors, dispute them with the appropriate credit bureau to potentially boost your credit score. You’ll need to show your lender that you have substantial enough income to support repaying a 15-year term. This can make it harder to qualify for a 15-year loan compared to a loan with a longer term. Whether you should refinance your mortgage to a 15-year term depends on your individual circumstances and financial goals.

What does it cost to refinance?

For high-cost areas, the limit is 150% of the baseline, which is $970,800. The 15-year fixed refi average rate is now 5.98 percent, down 10 basis points from a week ago. The majority of closely watched mortgage refi rates sunk lower today, December 20th, according to data compiled by Bankrate. We’re transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money.

Prepayment penalty usually takes effect for the first 3 years of a mortgage. Some lenders may allow you the prepay up to 20% of your principal during the penalty period before the fee is prompted. To be safe, you can wait for the penalty period to lapse before making additional payments. To understand the difference between a 15-year FRM and a 30-year FRM, here’s an example.

Today's national 15-year mortgage rate trends

The rate averages tend to be volatile, and are intended to help consumers identify day-to-day movement. The current 30-year, fixed-rate mortgage refinance rate is averaging 6.62%, according to Bankrate, while 15-year, fixed-rate refinance mortgages average of 5.93%. That can literally equate to saving thousands of dollars in the long term." In general, refinance closing costs are 3% to 6% of the loan balance. The type of the loan you are refinancing into can impact its cost in a few different ways. On the other hand, if you have enough equity, you could refinance into a conventional loan to possibly get rid of the mortgage insurance requirement.

Shorter terms are also available in the market, such as 10-year and 20-year fixed-rate options. Likewise, you can choose a shorter loan from the get-go if you can afford it. For instance, you’ll notice many homeowners with 30-year fixed-rate loans. Meanwhile, there are shorter payment terms available in the market, such as 15-year fixed mortgages. You might be wondering, when is it a good idea to get a 15-year fixed mortgage? You should also know the requirements you must satisfy to be eligible for this type of loan.

Rocket Mortgage by Quicken Loans – Best for online

The following are some strategies that could help you secure the best possible rate on your loan. Opting for a shorter, 15-year term can help you pay off your mortgage more quickly compared to borrowers who choose longer terms. Less time to own your home – With a 15-year term, you’ll pay off your loan in half the time of the more common 30-year term loan. The opportunity cost of tying up money in home equity instead of other financial assets. Rates on 15-year loans are significantly lower than rates on 30-year loans.

Bankrate follows a strict editorial policy, so you can trust that our content is honest and accurate. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. The content created by our editorial staff is objective, factual, and not influenced by our advertisers.

If your credit score is less than 500, work on improving it before applying for a mortgage, because most lenders won’t issue a loan to someone with a score of 499 or lower. Conversely, if your credit score is higher than these minimums, you may be able to get a better interest rate. Because many homeowners locked in record-low rates in 2020 and 2021 and they've since since gone up, refinancing generally isn't a money-saving move at this time. Consider refinancing in the future if prevailing interest rates fall below the rate you currently have on your mortgage.

If you currently have a 20- or 30-year loan and want to shorten your repayment term, refinancing to a 15-year mortgage could be a good option to save money on interest. Additionally, lenders typically offer lower rates on loans with shorter terms, meaning you could reduce your overall interest costs even more. A 15-year fixed refinance is a new home loan that replaces your current mortgage. The interest rate is fixed and you must pay the loan off within 15 years. If you are replacing a 30-year mortgage with a 15-year one, you can secure a lower interest rate, but the tradeoff is higher monthly payments.

Our site has comprehensive free listings and information for a variety of financial services from mortgages to banking to insurance, but we don’t include every product in the marketplace. In addition, though we strive to make our listings as current as possible, check with the individual providers for the latest information. The current 30-year, fixed-rate mortgage refinance is averaging 6.62%, compared to 6.62% last week and the 52-week low of 6.62%. Lenders discourage early mortgage repayment by charging prepayment penalty. This extra charge forfeits any savings you make from extra payments.

However, with a 15-year loan, you’ll have a higher monthly payment. If you can afford the larger payments, refinancing to a 15-year loan can help you reach homeownership sooner while saving you a bundle on interest. A larger portion of your monthly payments will go toward the loan principal rather than interest. The loan terms shown above do not include amounts for taxes or insurance premiums.

Bankrate logo

If you don’t mind a higher monthly payment, you might find a 15-year mortgage to be a more attractive option than a longer-term loan. If you’re looking to refinance, it’s smart to consider a 15-year loan, especially if you’re more than halfway through repaying your current 30-year loan. Refinancing into another 30-year loan would extend your repayment period, which costs more in the long run. Some people choose an ARM when they purchase their home, perhaps because they didn’t plan to stay in the home for long or needed a low monthly payment to get settled.

No comments:

Post a Comment